Designing a well-balanced liquidity strategy in the face of uncertainty

Brent Turner, CTP is the regional director of strategy for Public Trust Advisors. He can be reached at brent.turner@publictrustadvisors.com.

Advertisement

Feeling confused and not knowing who or what to believe? In the world of public funds investing, you are not alone.

To date, the Federal Open Market Committee has increased the upper bound of the Federal Funds Target Rate from 0.25% to 4.5% since March 2022. The Federal Reserve aggressively hiked interest rates at seven meetings, including four consecutive, unprecedented, 75-basis point moves. The last time that the Fed raised rates by 3% or more in a single year was in 1981.

There is no shortage of opinions as to what the Fed will or will not do in 2023. There is a strong argument for treasurers and finance directors to preemptively label any projections or forecasts they are unfortunate enough to be subjected to by a more accurate term: “speculation.” That said, the undeniable fact is that this recent and historical tightening of monetary policy has transformed cash into a compelling asset class.

For the first time in a long time, there are meaningful returns to be earned in the cash asset class.

Benefits of stable $1.00 NAV investment pools

Joint powers authority (JPA) investment pools like California CLASS are not merely a place to hide from volatility or a temporary location to allocate funds into longer-dated securities. Lagging interest rates for bank deposit products also bolster the argument for evaluating the merits of ‘AAAm’ rated JPA pools that offer daily liquidity and transact at a stable $1.00 net asset value (NAV).

‘AAAm’ is the highest rating assigned to principal stability funds. An ‘AAAm’ rating by S&P Global Ratings is obtained after S&P evaluates a number of factors including credit quality, market price exposure, and management.

Investing in a stable $1.00 NAV investment pool is the foundation of a well-balanced liquidity strategy. One very important characteristic of an ‘AAAm’ rated pool is that it will have a weighted average maturity of less than 60 days.

A weighted average maturity is an average of the effective maturities of all securities held in a portfolio, weighted by each security’s percentage of net assets. The higher the weighted average maturity, the longer it takes for all the securities to mature and repay their principal. The shorter the weighted average maturity, the sooner the securities mature.

For example, the California CLASS Prime investment pool’s weighted average maturity is less than 40 days as of Jan. 12, 2023. Comparing the weighted average maturity of various investment options will provide insight as to why one investment pool is offering a higher net yield to participants in either a rising or declining interest rate environment.

In a rising rate environment, the investment pool with the shorter weighted average maturity will reinvest maturing securities at higher rates sooner than will a pool with a longer. In other words, the yield of a pool with a shorter weighted average maturity will be impacted by any Fed policy decision faster.

Using enhanced cash-style (variable NAV) investment pools

The Fed has demonstrated its willingness to aggressively bring inflation in line with its price stability mandate. But at some point, the Fed will stop tightening monetary policy. Federal Reserve Chair Jerome Powell noted that when it does, the Fed will consider cutting interest rates to invigorate an economy whose growth was necessarily nudged into by the current tightening regime.

An enhanced cash-style investment pool is one option that public agencies can consider as part of a balanced liquidity strategy. The California CLASS Enhanced Cash investment policy mirrors California state statute with respect to permissible investments and maturities.

Enhanced cash pools are generally managed to a weighted average maturity greater than 60 days. By investing farther out the yield curve — buying some securities with a longer maturity than the ones in a stable $1.00 NAV pool — they often generate higher interest income than stable NAV pools.

This enhanced performance is accompanied by higher interest rate risk. Pools like California CLASS Enhanced Cash absorb and transmit that risk by operating as variable NAV pools. This means that the transactional share price can fluctuate as the values of the securities within the portfolio increase or decrease inversely to changes in yields.

When interest rates are decreasing, a pool with a longer weighted average maturity can generate a higher rate of return than one with a shorter weighted average maturity. This is because the shorter weighted average maturity pool is forced to invest maturing securities’ proceeds at lower prevailing rates, while a longer weighted average maturity pool is “locked in” to higher rates for longer.

Investors in a variable NAV pool can see the NAV increase as yields fall. This offers investors the opportunity for their liquidity strategy to generate price appreciation in addition to interest income. This price appreciation comes from a change in the NAV that corresponds with a decrease in rates. The opposite holds true as well: When rates increase, the NAV can decline.

Tying things together

Here are a few key things to remember when investing. First, when rates are rising, allocating funds to stable $1.00 NAV investment pools with a short weighted average maturity may facilitate the capture of rising interest rates. When rates are plateauing or falling, investing in a variable NAV-enhanced cash pool can generate higher interest income than its stable $1.00 NAV counterpart.

Second, a well-balanced liquidity strategy does not entail trying to time the allocation of funds between stable and variable NAV pools. Rather, it uses both pools in a complementary and disciplined manner. This diversified approach can optimize the performance of a city’s liquidity management strategy when compared to an approach that attempts to time the market or avoids developing a strategy altogether.

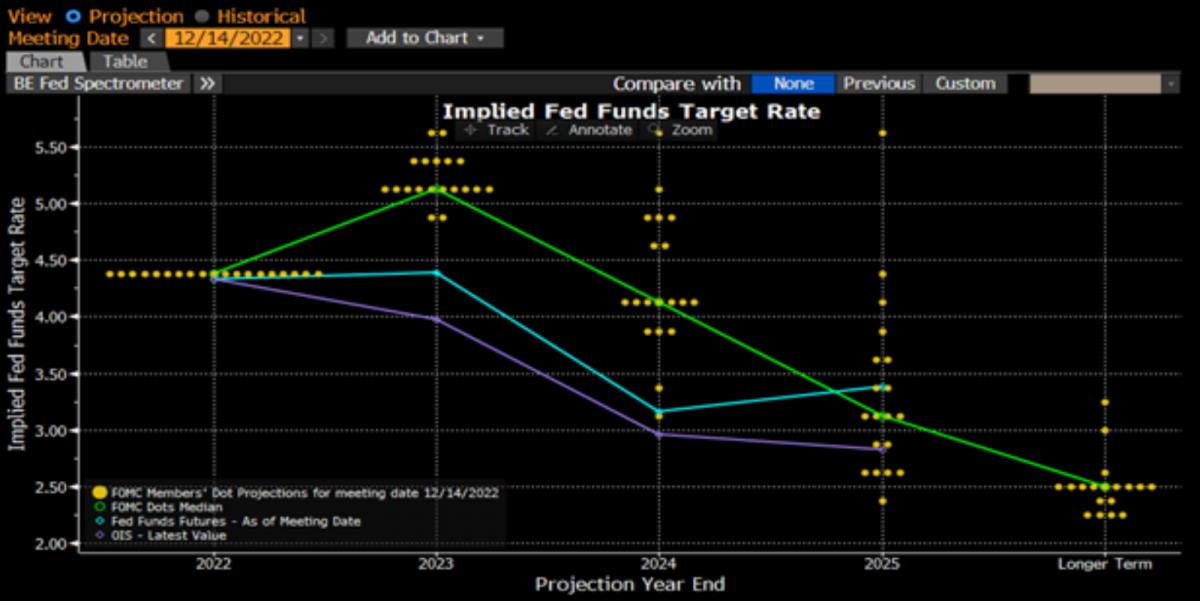

Finally, it is impossible to time the markets. Consider the Fed’s dot plot from this time last year to what we have experienced. The Fed was projected to hike rates one time in 2022. It ended up raising the target rate range seven times.

What will managers of public funds experience between the date of this article’s publication and January 2024? No one knows. Year after year, the Fed and well-compensated economists attempt to forecast interest rates, and they very rarely get it right … and they have all the data! The best that any manager of public funds can do is construct a well-balanced portfolio that is prudently positioned to weather the only thing we can all be certain about: interest rate uncertainty.

The disciplined development and execution of your city’s liquidity strategy are firmly within your control. Steward those processes carefully and your city will benefit from your thoughtful expertise.

Launched in response to the growing investment needs of public agencies, California CLASS provides an additional investment option for agencies’ daily liquidity and strategic reserve investments encompassing all of these objectives. The investment program, sponsored by the League of California Cities and the California Special Districts Association in collaboration with Public Trust Advisors, LLC, is a California joint powers authority governed by a board of trustees comprised of city and special district finance professionals.