Historic Preservation: A Springboard For Economic Development

Yvonne Hunter is co-director of the Sustainability program for the Institute for Local Government (ILG) and can be reached at yhunter@ca-ilg.org. For more about ILG, visit www.ca-ilg.org.

William J. Murtagh, the first keeper of the National Register of Historic Places, wrote in 1988, “It has been said that, at its best, preservation engages the past in a conversation with the present over a mutual concern for the future.”

This remains true today as local agencies throughout California use the past to promote economic development and financial vitality in their communities for the future.

Pasadena Builds a Sense of Community

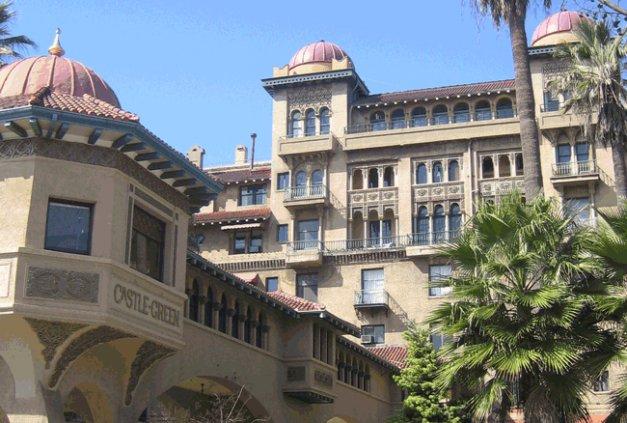

Thirty years ago, many viewed historic preservation as an obstacle to progress. But according to Pasadena Mayor Bill Bogaard, in the 1980s historic preservation was recognized as a significant factor in determining what type of community the City of Pasadena wanted to be. Rather than demolish the city’s historic downtown area and make it a corporate corridor, an approach opposed by a number of local activists, the city worked with the community to retain the downtown area’s historic nature. Over time, by involving the community and adopting policies and programs designed to encourage the preservation of historic properties, the city saved historic Old Pasadena, the Colorado Street Bridge and the Pasadena Playhouse, among other properties. Today about 4,000 Pasadena properties are designated historic, either by the National Register of Historic Places or the city.

“Historic preservation combines with other factors, such as urban design and creating a sense of place, to build strong communities,” says Bogaard. “It also connects with jobs, property values, heritage tourism and downtown revitalization.”

To effectively undertake such an effort, a community needs incentives to support historic preservation and balance real or perceived barriers, according to Kevin Johnson, a planner with the City of Pasadena’s Planning and Community Development Department. Pasadena voluntarily participates in the Mills Act program, which provides property-tax savings for owners of historic properties that meet specific criteria. The average tax savings is about 54 percent, and the impact on the city’s budget is minimal. Pasadena also waives certain development standards, such as two-car parking requirements, for eligible properties to facilitate restoration and reuse of historic sites. In addition, federal incentives help Pasadena property owners preserve their buildings. For example, preservation easements allow the property owner to receive a tax benefit by “donating” the building’s facade to a local historic nonprofit organization.

New Economic Realities

According to Laura Cole-Rowe, executive director of the California Main Street Alliance, communities are looking for ways to connect historic preservation with economic development, especially after the Great Recession. The California Main Street Alliance is a nonprofit association that supports participants in the California Main Street Program. This program is part of a national movement to improve the quality of life in America’s towns, cities and neighborhoods by reinvigorating the economic health of their historic Main Street central business districts. It often is less expensive to save a building and retrofit it than to tear it down and construct a new building, says Cole-Rowe. Furthermore, reuse is often more “green” than starting from scratch. With the demise of redevelopment, historic preservation options for reuse are becoming more attractive.

Investing in historic restoration has an economic multiplier effect. The National Main Street Center reports that in 2012, for every $1 that communities participating in the California Main Street Program invested in supporting the program’s operation, $22 were invested by both the public and private sectors, exceeding the national average reinvestment ratio.

Livermore’s Downtown Embraces Its History

The City of Livermore has made a strong commitment to its historic downtown. “We see our historic buildings and locations as telling our story,” says Rachael Snedecor, executive director of Downtown Livermore, Inc., a nonprofit public-private partnership. “Elected officials, city staff, property owners, heritage guild members, historic preservationists and business owners all share the core value of maintaining our heritage while bringing hip, modern uses to the area.”

Like many other cities, Livermore felt the impact of suburban sprawl and a four-lane highway that funneled traffic through its downtown. The city embarked on a downtown revitalization effort, investing $12.5 million in roadway and public space improvements. This effort transformed downtown into an area with shops, restaurants and a public plaza that reflects the city’s historic cattle and wine industries, which helped create the city. Between 1986 and 2009, downtown Livermore added 194 new businesses, 974 new jobs, 82 building rehabilitations and 12 new buildings and realized a 17 percent drop in the vacancy rate along with $55 million in public investment and $112 million in private investment. Livermore received the Great American Main Street Award® in 2009 for its efforts.

In downtown Livermore, a historic blacksmith shop now houses a bistro, wine-tasting room and local olive oil boutique. A historic butcher shop comprises a French bakery, fashion boutique and portrait studio. The businesses benefit from these unique locations and provide additional attractions for residents and visitors.

“I often wonder if any of these spots are haunted by ghosts of the past,” says Snedecor with a smile. “If they are, how fun it must be for folks from years ago to see the vitality and life continuing today in downtown Livermore!”

Arcata Blends the Arts, Preservation and Economic Development

The City of Arcata has a vibrant historic preservation community that has designated 104 buildings citywide as historic. Over the years, Arcata has completed a facade rehabilitation program around its downtown plaza and encouraged adaptive reuse projects that turn aging, distressed historic buildings into centers of activity. The Arcata Theatre, a historically significant movie house built in the combined Art Deco and Art Moderne styles, was transformed into a multifunctional entertainment venue. The project breathed new life into this old building while helping to invigorate Arcata’s downtown nightlife. Another effort, the Robert Goodman Winery Adaptive Reuse Project, included remodeling an existing historic home for offices and an owner’s apartment and renovating the former machine shop to create a wine-tasting room, juice bar and restaurant.

Playhouse Arts, a grassroots initiative led by the arts community, received a grant in 2012 from the National Endowment for the Arts’ Our Town program to help plan a creative industry corridor in Arcata’s Creamery District. “Arcata has a vibrant artists’ community,” says Arcata Vice-Mayor Mark Wheetley. “We want to blend and build on the energy of that community with pragmatic business concepts to stimulate economic vitality.” The city is a partner in the Creamery District and has begun to explore mixed-use zoning criteria, street lighting, signage and trail improvements to promote the Creamery District’s revitalization.

Wheetley advocates hands-on community collaboration to achieve historic preservation and economic vitality goals. The community participated in an intensive effort to gather design options and creative ideas for the Creamery District. “Ultimately, community engagement helps promote neighborhood awareness and shared ownership in a successful outcome,” says Wheetley. “When everyone rolls up their sleeves and goes to work, you can integrate compatible goals that pave the way for the city to adopt supportive and sustainable policies. This lays the foundation for the private sector to support future historic preservation and capture economic opportunities.”

Conclusion

Recognizing the importance of historic preservation to a community’s identity and sense of place, along with a desire to strengthen their community’s economic base, California’s local leaders are having conversations with residents and businesses to identify opportunities to combine historic preservation and economic development. The results reflect the variety among California communities, creating more dynamic places in which to live, work and play.

Links to Information Included in the Article

City of Arcata - Arcata Playhouse and Creamery

District Website

City of Livermore - Livermore Downtown

City of Pasadena

- Pasadena Historic Preservation

- Pasadena Historic Preservation incentives and regulations

- Development Standard Waivers for Multi-Family Residential Projects (scroll down to subsection C)

- Two-car parking waiver, fee reductions, Mills Act code provisions

- Variances for Historic Resources (scroll down to subsection H)

California Main Street

Alliance

Great

America Main Street Awards

California Main Street Program

Overview of Historic Preservation Resources

The information provided here is adapted or taken from state and federal websites. Underlined text reflects hyperlinks to online resources.

California State Historical Building Code

California’s requirements for historic preservation are based upon the California State Historical Building Code (CHBC).1 The CHBC is intended to save California’s architectural heritage by recognizing the unique construction issues inherent in maintaining and adaptively reusing historic buildings. The CHBC provides alternative building regulations for permitting repairs, alterations and additions necessary for the preservation, rehabilitation, relocation, related construction, change of use, or continued use of a “qualified historical building or structure.”

Section 18955 of the CHBC defines a “qualified historical building or structure” as “any structure or property, collection of structures, and their associated sites deemed of importance to the history, architecture, or culture of an area by an appropriate local or state governmental jurisdiction. This shall include structures on existing or future national, state or local historical registers or official inventories, such as the National Register of Historic Places, State Historical Landmarks, State Points of Historical Interest, and city or county registers or inventories of historical or architecturally significant sites, places, historic districts, or landmarks. This shall also include places, locations, or sites identified on these historical registers or official inventories and deemed of importance to the history, architecture, or culture of an area by an appropriate local or state governmental jurisdiction.”

The CHBC’s standards and regulations are intended to facilitate the rehabilitation or change of occupancy so as to preserve their original or restored elements and features, to encourage energy conservation and a cost effective approach to preservation, and to provide for reasonable safety from fire, seismic forces or other hazards for occupants and users of such buildings, structures and properties and to provide reasonable availability and usability by the physically disabled.

California Office of Historic Preservation

The California State Office of Historic Preservation (OHP) is responsible for administering federally and state mandated historic preservation programs to further the identification, evaluation, registration and protection of California’s irreplaceable archaeological and historical resources. OHP’s responsibilities include:

- Identifying, evaluating and registering historic properties;

- Ensuring compliance with federal and state regulatory obligations;

- Encouraging the adoption of economic incentives programs designed to benefit property owners; and

- Encouraging economic revitalization by promoting a historic preservation ethic through preservation education and public awareness and, most significantly, by demonstrating leadership and stewardship for historic preservation in California.

Local Government Assistance Program

OHP promotes a comprehensive approach to historic preservation at the local level. OHP’s Local Government Unit (LGU) offers guidance and assistance to city and county governments in the following areas:

- Drafting or updating historic preservation plans and ordinances;

- Developing historic context statements;

- Planning for and conducting architectural, historical and archeological surveys;

- Developing criteria for local designation programs, historic districts, historic preservation overlay zones (HPOZs) and conservation districts;

- Developing and implementing design guidelines using the Secretary of the Interior’s Standards;

- Developing economic incentives for historic preservation;

- Training local historic preservation commissions and review boards; and

- Meeting CEQA responsibilities with regard to historical resources.

Certified Local Government Program

The Office of Historic Preservation administers the Certified Local Government Program. Amendments to the National Historic Preservation Act of 1966 provided for the establishment of a Certified Local Government Program to encourage the direct participation of local governments in the identification, evaluation, registration and preservation of historic properties within their jurisdictions and promote the integration of local preservation interests and concerns into local planning and decision-making processes. The Certified Local Government Program is a partnership among local governments, the State of California-OHP and the National Park Service (which is responsible for administering the National Historic Preservation Program). The Office of Historic Preservation distributes at least 10 percent of its annual federal Historic Preservation Fund allocation to Certified Local Government programs through a competitive grant program to assist Certified Local Governments in preservation planning activities.

California Main Street Program

In 1986, California joined a growing national movement to improve the quality of life in America’s towns, cities and neighborhoods by reinvigorating the economic health of their historic Main Street central business districts. Developed by the National Trust for Historic Preservation more than 25 years ago and administered by the nonprofit National Main Street Center of the National Trust for Historic Preservation, the Main Street Program has utilized a public-private partnership of private investment, local government support and local nonprofit assistance to revitalize historic commercial districts. The locally driven, grassroots, self-help “Main Street Approach” focuses on four points: organization, promotion, design and economic restructuring.

The Mills Act Property Tax Abatement Program is an important preservation financial incentive program in California. Mills Act contracts are between the property owner and the local government granting the tax abatement. Each jurisdiction individually determines the criteria and requirements for participation. Not all local governments participate in the Mills Act Program. As of 2011, 85 cities and counties participate in the Mills Act Program.3

The Mills Act Program is administered and implemented by local governments. Each local government establishes its own criteria and determines how many contracts it will allow in its jurisdiction. The State Board of Equalization provides guidelines for county assessors for use in assessing properties under the Mills Act.

National Trust for Historic Preservation

The National Trust for Historic Preservation, a privately funded nonprofit organization, works to save America’s historic places.

Over the past 30 years, the Main Street movement has transformed the way communities think about the revitalization and management of their downtowns and neighborhood commercial districts. Cities and towns throughout the nation have come to see that a prosperous, sustainable community is only as healthy as its core. (See also California Main Street Program.)

Federal Tax Credits and Financial Incentives

Federal Historic Preservation Tax Credit Program

The Federal Historic Preservation Tax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings.

Information about various preservation tax incentives provided on the National Park Service website.

Federal Tax Deductions – Easements

Charitable contributions (easements) for historic preservation purposes are available from the federal government. The Tax Reform Act of 1986 retains the provisions established by Section 6 of the Tax Treatment Extension Act of 1980 (IRC Section 170) that permit income and estate tax deductions for charitable contributions of partial interest in historic property.

Generally, the IRS considers that a donation of a qualified real property interest to preserve a historically important land area or a certified historic structure meets the test of charitable contribution (easements) for conservation purposes. For purposes of the charitable contribution provisions only, a certified historic structure need not be depreciable to qualify. It may be a structure other than a building and may also be a remnant of a building such as a facade, if that is all that remains, and may include the land area on which it is located.

Other Potential Funding Sources for Historic Preservation

The following information is taken from the California Office of Historic Preservation website.

The California Council for the Humanities offers grant programs that promotes cultural projects. Communities Speak funds projects that use story and storytelling to address pressing contemporary issues. The California Documentary Project sponsors documentary images and text of contemporary California life. The California Story Fund grants funds to unique story projects throughout the state.

The Getty Conservation Institute supports efforts to preserve buildings, sites, and designed landscapes of outstanding architectural, historical, and cultural significance. Planning Grants assist in the initial development of an overall conservation plan. Support is also available on a selective basis for the development of archaeological site management plans. Implementation Grants assist in the actual conservation of a building’s historic structure and fabric.

The Home Depot Foundation is dedicated to creating healthy, livable communities through the integration of affordable housing built responsibly and the preservation and restoration of community trees. The foundation makes grants to 501(c)(3) tax-exempt public charities in the United States. Preference is given to proposals that include community engagement that result in the production, preservation, or financing of housing units for low- to moderate-income families which meet certain criteria including resource conservation, green building, innovations in materials or technology, and smart site planning and land use.

The National Endowment for the Humanities offers a variety of planning and implementation grants for various projects involving historical and cultural organizations.

The National Trust for Historic Preservation offers several types of financial assistance for preservation-related projects.

Partners for Sacred Places is a national, nonsectarian, nonprofit organization dedicated to helping congregations with older historic buildings sustain and actively use their sacred places.

Save America’s Treasures provides federal funds for preservation of nationally significant historic resources.

The United States Small Business Administration guarantees small business low-interest loans for purchasing property, construction, inventory and other business expenses. It also provides training and educational programs to assist small business owners with business plans, budgeting and management.

The History Channel is offering Save Our History grants to history organizations, historical societies, libraries, archives and nonprofit organizations that partner with schools and/or youth groups on projects that teach students about their local history and actively engage them in its preservation.

Miscellaneous Resources

Institute for Local Government Sustainable Economic Development Resource Center

Economic Reasons for Investing In Historic Preservation

From the Advisory Council on Historic Preservation

Sustainability and Preservation

The California Office of Historic Preservation online resource includes links and information on green building, energy efficiency and other sustainability topics related to historic preservation.

Implementing Solar PV Projects on Historic Buildings and in Historic Districts

National Renewable Energy Laboratory publication focuses on the implementation of solar photovoltaic systems on historic properties.

Preservation Brief 3: Improving Energy Efficiency in Historic Buildings

National Park Service publication.

Measuring Economic Impacts of Historic Preservation

Study commissioned by the Advisory Council on Historic Preservation.

The Seismic Retrofit of Historic Buildings: Keeping Preservation in the Forefront

National Park Service publication

Advisory Council on Historic Preservation

Includes useful publications related to historic preservation, economics of historic preservation and youth and historic preservation.

Publications related to the economics of historic preservation.

Footnotes:

[1] See California Health and Safety Code, Sections 18950 to 18961 of Division 13, Part 2.7.

[2] See Government Code Sections 50280 – 50290 and California Revenue and Taxation Code, Article 1.9, Sections 439 – 439.4.

[3] Based upon information included on the Office of Historic Preservation website.

This article appears in the September 2013 issue of Western

City

Did you like what you read here? Subscribe

to Western City