Everything (well, almost) you need to know about sales tax but were afraid to ask

Jessica Sankus is the senior policy and legislative affairs analyst for the League of California Cities; she can be reached at jsankus@calcities.org.

Have you ever wondered what happens with the sales tax you pay at a retail counter or online? What can cities do with that money? If you are a newly elected official, you may have asked these questions — and more — while navigating your city’s budget development process.

For most cities, sales tax revenues are the base of a healthy pyramid of municipal revenue, alongside property taxes and other local taxes. Here are 10 things you should know about California’s sales and use tax to be an informed steward of local fiscal resources.

1. Sales tax: A tale as old as 1933!

California voters approved the first sales tax in 1933. Over the past 90 years, sales taxation, collection, and allocation have undergone several transformations along a winding journey of tinkering, exemptions, and evolving state bureaucracy. These changes have had a profound impact on local government revenues.

There is one constant though. A sales tax is the tax that retailers add to the price of most goods sold in California. The tax base for the sales tax is the retail or rental price of tangible personal property — any physical asset that is readily movable and not permanently attached to real property. Sales tax applies to a transaction if the seller’s registered place of business in California participates in the sale and the goods are passed to the customer within this state.

Sales tax is administered and distributed by the state but includes both state and local levies. After 1933, California cities began to impose their own sales taxes. These taxes and their collection methods varied greatly, so in response, the state Legislature passed the Bradley-Burns Uniform Local Sales and Use Tax Law in 1955.

2. Bradley-Burns?

The Bradley-Burns Uniform Sales and Use Tax Act is a uniform, statewide system of sales taxation and collection that allows cities to adopt local sales and use tax rates up to 1% of taxable sales in their jurisdictions. Although the state collection and distribution give this the appearance of a revenue-sharing arrangement, the Bradley-Burns is a locally levied tax with local discretion to use those revenues.

Today, all cities and counties in California impose a Bradley-Burns Uniform Local Sales and Use Tax. The basic Bradley-Burns rate is a general tax, meaning its uses are unrestricted and can be used for general government purposes. General taxes must go into a city’s general fund. Other revenues or funding sources are required to be in separate funds, such as special taxes or grant funding. Usually, a general fund is a municipality’s largest fund.

On average, the local sales tax provides around 30% of a city’s general purpose revenues. However, local sales taxes are among the most volatile types of taxes from year to year depending on the nature of the local economic conditions and amounts vary widely among cities. In some cities, the sales tax provides as much as 75% of general fund revenues; in a few cities, it is less than 5%.

3. What is the “use” part of the sales and use tax?

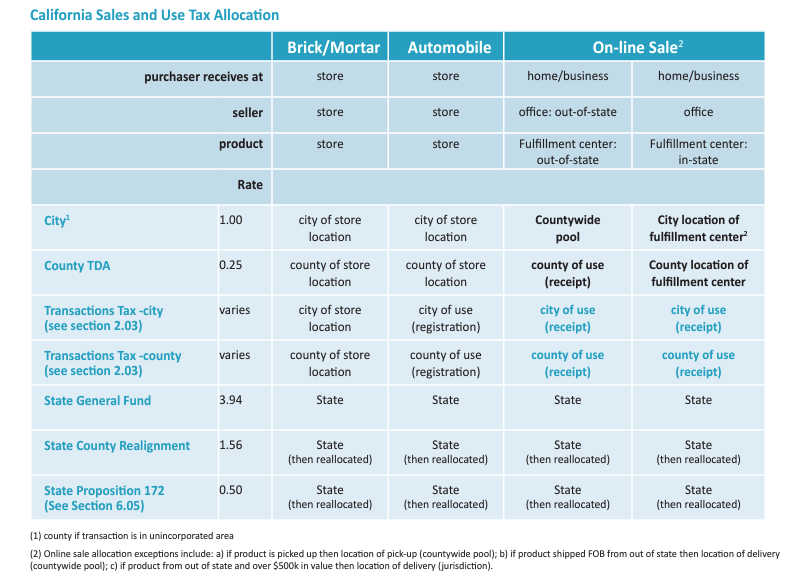

California’s use tax complements the sales tax. The use tax is imposed on the storage, use, or other consumption of property purchased from a retailer in cases where the sales tax is not collected. Use tax is commonly paid on goods purchased out-of-state, long-term lease payments, private vehicle transactions, and construction contractors. Unlike the sales tax, use taxes are generally allocated to the place of use. State law provides various special allocation procedures for use taxes collected on certain products.

4. We’re all swimming in a pool

California uses a countywide pool system to allocate local sales and use tax payments that cannot be identified with a specific place of sale or use. The formula for determining the amount owed to each municipality within a county is based on the proportion of each city’s taxable sales to the county as a whole. Generally, a city generating 4% of all taxable sales in a county receives 4% of the pool.

The largest components of the pools include private vehicle sales, use tax paid by construction contractors, merchandise shipped directly to consumers, permit holders who operate in more than one local jurisdiction, and use tax on purchases not tied to a retail facility, such as research and development.

5. Voter-approved restrictions and protections

Like many policy areas that experience large pendulum swings over time, the past few decades saw several significant changes to how local revenues are restricted and protected. In 1996, voters expanded restrictions on local government revenue raising through Proposition 218. The measure allows voters to repeal or reduce taxes, assessments, fees, and charges. It also reiterates the requirement for voter approval for special taxes and general taxes and imposes limitations on certain assessments and fees.

In 2004, voters approved Proposition 1A, constitutionally protecting major city revenues from additional shifts to the state and strengthening local governments’ ability to get reimbursement for unfunded state-mandated programs. Voters passed another measure to protect local government finances in 2010. Proposition 22 prohibits the state from borrowing, delaying, or taking certain funds allocated to local governments.

Collectively, these measures prohibit the state from reducing the local sales and use tax rate or altering its allocation method.

6. A guide to the state’s alphabet soup

Correctly recalling the state administrative agencies that share in the assessment, collection, distribution, and general oversight of taxes and fees can be challenging, even for seasoned lawmakers! The most relevant state administrative agencies for local officials are the Board of Equalization (BOE), the California Department of Tax and Fee Administration (CDTFA), and the Office of Tax Appeals (OTA).

The BOE was responsible for property tax assessments, state-administered fees, and other taxes, such as sales, use, and transaction taxes. In 2017, lawmakers reduced its functions to core responsibilities primarily related to property tax. Various other tax administration duties were transferred to the newly formed CDTFA and OTA. The OTA hears appeals from California taxpayers regarding various taxes and fees administered by the CDTFA and the Franchise Tax Board (FTB).

The CDTFA administers California’s sales, use, and transaction taxes. The agency collects revenues, enforces compliance, and allocates revenues among local jurisdictions and the state. The CDTFA is often confused with FTB, which is responsible for collecting state personal income taxes and corporate taxes. Those revenue sources are exclusive to the state.

7. Follow the money

Generally, revenue from the Bradley-Burns Local Sales and Use Tax is allocated to the city where the sale occurs or the county for unincorporated areas. However, when the consumer, the seller, and the taxable good are in different locations — such as for an online purchase — the allocations are trickier. Understanding these nuances is important though.

Changes in consumer behavior, such as increased online shopping throughout the COVID-19 pandemic and the slow return to brick-and-mortar retail sales, drove shifts in sales tax allocations, which has affected city budgets statewide. More information on how local sales taxes are allocated is detailed in Local Sales and Use Tax “Sourcing”: Rules for Rate and Allocation.

8. Every rule has an exemption

Contrary to popular belief, California has the narrowest sales tax base in the country. Although the overall sales tax rate is higher than most states, California has the smallest pool of taxable goods. Services commonly taxed in other states — but not in California — include dry cleaning, automobile or appliance repair, extermination services, lawn care, swimming pool cleaning, and digital downloads.

Sales tax also does not apply to the sale of real property, such as land and buildings. The state continues to narrow the base of goods that are taxed with additional exemptions. For example, cities cannot collect tax on most groceries, utilities, museums, public art, manufactured housing, and custom computer programs, just to name a few!

9. Watch out for these proposals

Every year, lawmakers introduce bills that would expand exemptions from the state and local sales and use tax. While the intent is usually laudable, the League of California Cities has concerns with proposals that erode the already constrained local government sales tax base. Beyond these fiscal concerns, Cal Cities fundamentally objects to how such sweeping sales tax exemptions undermine local voters and citizens’ initiatives.

There are also attempts to change how taxes are collected and allocated by organizations with less altruistic motives. Earlier this year, the California Business Roundtable succeeded in qualifying the deceptively named Taxpayer Protection Act for the 2024 November election. If passed, it would significantly restrict the ability of cities to fund critical services.

The initiative adopts new and stricter rules for raising state and local taxes, fees, assessments, and fines/penalties, limits voter authority and accountability, and significantly jeopardizes public services. Any new or increased tax or fee adopted by the Legislature, a city council, or the local voters after Jan. 1, 2022, would have to comply with the Act’s new rules.

10. But what, there’s more!

Whether you are advocating on these issues or just trying to find your way through the maze of government finance, Cal Cities is here to help. Cal Cities and its partners have developed a suite of entry-level resources over the years, including:

- The California Municipal Revenue Sources Handbook (League of California Cities)

- A Primer on California City Revenues, Part One: Revenue Basics (Western City)

- A Primer on California City Revenues, Part Two: Major City Revenues (Western City)

- Financial Management for Elected Officials (Institute for Local Government)

- Public Engagement in Budgeting (Institute for Local Government)

The California Local Government Finance Almanac and Government Finance Officers Association also have a vast library of resources. The Guide to Local Government Finance in California and A Public Official’s Guide to Financial Literacy are also great resources for city officials.

For city-specific questions, there is at least one person at city hall that would be more than happy to provide a detailed briefing: your fiscal officer! For all other questions, please contact Cal Cities Legislative Representative Ben Triffo.